|

Why Does It Work?

Why does our risk management system work?

Human Nature Drives Markets At Extremes Our belief is that markets are driven by human emotions and crowd behavior at price extremes -- market tops and bottoms. The fact that bubbles and panics have consistently occurred over the centuries and across many geographies and cultures is evidence that fear and greed, euphoria and despair, are universal emotions that can be relied upon to repeat themselves. Because the human behavior repeats, certain measures of price, volume, divergences, breadth and monetary conditions, can be assumed to be correlated with market tops and bottoms. Past behavior.... |

|

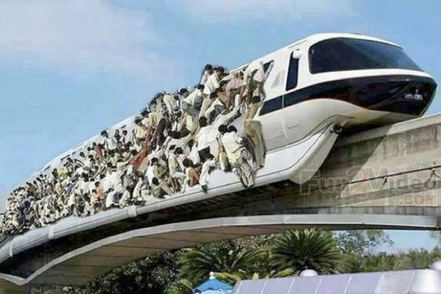

Same behavior. We all still get on the train! |

|

Academic Studies Have Confirmed Markets Are Driven By Consistent Human Behaviors In 2005, Kevin Lansing authored a study at the Federal Reserve Bank of San Francisco in which he created a behavior model to test his hypotheses about human behavior and stock market bubbles. His model showed that it doesn’t take very much human error to generate extrapolative expectations. If people start believing, even for a short time, that recent trends are the new normal, they will start paying higher prices, which locks the trend in place and lends credence to their belief. Eventually things spiral out of control before they come to their senses. According to Lansing, investors have rational incentives to economize on the costs of collecting and processing information. “The most readily available and least costly information about the future value of a variable is its past value.” Source: http://www.frbsf.org/economic-research/files/wp04-06bk.pdf Those Who Study History Recognize Human Emotions Are Drivers Of Markets

The fact that bubbles, crashes and panics have consistently occurred throughout history is evidence that irrational human behavior drives markets to unreasonable levels. Some examples are provided below:

In summary, human emotions drive markets at extremes. Past human behavior will be similar to future human behavior. If we can identify indicators whose measures are associated with market extremes, we will be able to identify periods in which market risk is much higher or much lower than average. Indicators Can “Sense” Conditions Associated With The Extremes Coincident With Bull and Bear Markets John Hussman of the Hussman Funds describes the value of using a combination of indicators together as a way to manage risk:

Indicators are objective and based on data. As Hussman noted above, indicators are best used when their signals are combined into a model, which is exactly what we have done with the Safeguard 1st Risk Model.

Our Willingness To Go To Cash Is An Advantage Being out of the market and in cash inherently reduces risk. See Cash Is Not Trash. Black Swan Events are unforeseeable and occur randomly. For these reasons, being out of the market completely and in cash a certain percentage of the time is by definition more robust and less risky than being in the market all of the time. Our Methods Are Not Attractive To Many Professional Investors And Large Institutions (Pensions/Insurance Companies) All quantitative investors and traders know that systems will work as long as they are not discovered. As more participate in a successful strategy, the excess returns from that strategy disappear. A number of features of our Safeguard 1st Risk Model are unattractive to institutions and large investors. Immediate action/response must be taken when signals are generated. A traditional investment committee may meet on the third Thursday following the end of a quarter. Such a structure would be much too slow to react to the much faster pace of our risk-management strategy. |

|

One must be willing to get into/out of the market completely. Our studies show that small, gradual adjustments to the percentage of allocations among different asset classes in a portfolio produces worse performance than Buy & Hold and doesn’t reduce risk by very much. Professionals have career risk if they make bold moves that cause their performance to deviate from their peers or the market. Our strategies provide real risk reduction because they can go to a 100% cash position when risk is high and back to being fully invested when risk subsides. Investors must follow the system by maintaining strict discipline, keeping emotions out of the investment process. Few retail investors or even professionals have the discipline to act continuously in an unbiased manner. The Risk Model may not always work, and one must maintain complete faith and continue to abide by the signals. Continued Belief and Adherence By the Majority of Asset Managers to the Efficient-Market Hypothesis (EMH). Developed by Professor Eugene Fama, EMH states that asset prices fully reflect all available information. In other words, there is no way to get an edge on the market and movements in the stock market are attributable to “noise.” A growing body of academic evidence disputes EMH, but as long as EMH is widely believed and followed, technical risk-management systems will continue to work. |