|

Is Your Portfolio Really Diversified?

We have seen the weaknesses in Buy & Hold. We have also described that the risk of relying on bonds only as a means of diversification in a traditional 60/40 portfolio is better than nothing, but will actually amplify the damage around 25% of the time. Now let’s examine portfolio diversification with multiple asset classes in a portfolio besides stocks and bonds, some of the difficulties of achieving true diversification, and how our strategies may help. What Is Diversification With Multiple Asset Classes Most high net-worth and ultra high-net worth investors have sophisticated investment portfolios which, in addition to U.S.-based, bond investments, include other asset classes for better diversification. These additional asset classes could include emerging market stocks, foreign corporate bonds, foreign sovereign bonds, and alternative assets like private equity funds, hedge funds, REITs, commodities (CTA’s), currencies, etc. The idea is to own assets that are not correlated to each other to reduce risk and drawdowns when markets get rocky, and to create a smooth path for investors on their way toward their investment goals. Diversification Is The Key To Investment Success |

|

"Diversification is both observed and sensible; a rule of behavior, which does not imply the superiority of diversification, must be rejected both as a hypothesis and as a maxim." (Markowitz, 1952)

|

|

We wholeheartedly agree with Markowitz, who introduced Modern Portfolio Theory and won a Nobel Prize for it. Diversification is the single best thing that an investor can do. But its success is dependent on having assets that are truly uncorrelated. As we have shown with bonds in The Achilles Heel of the 60/40 Portfolio section of this website, the problem is, at the present time, most investors don’t have what they think they have in their portfolios.

There are two principle reasons for this:

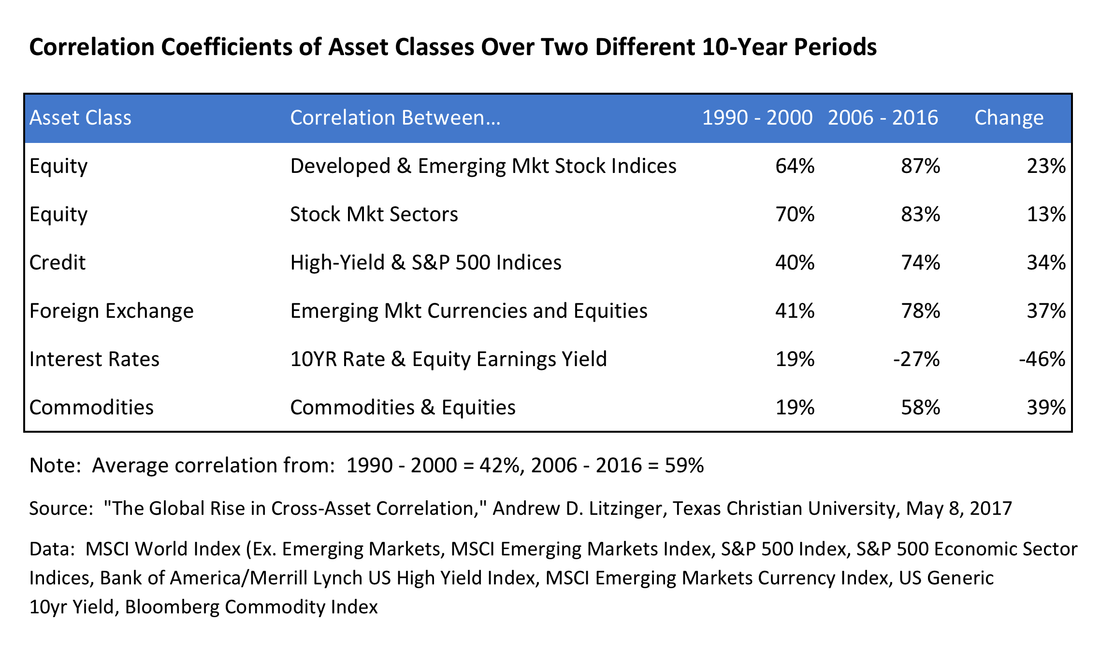

Asset Classes Are Becoming More Correlated In the past 20 years, asset classes that use to be non-correlated with stocks are becoming increasingly correlated. This is true across different asset types and across different geographies. In the past it was much easier to construct a diversified portfolio. Today, diversification is more difficult to achieve. Why are correlations increasing? Integration of the global economies through freer trade and outsourcing of labor, as well as the increased efficiency and globalization of financial markets are the principle reasons. More recently, coordinated easy-money policies among the world’s major central banks have driven global investors to seek return wherever it may be, with less regard for risk, driving risk premier down almost everywhere. The table below demonstrates the increasing correlations across asset classes and geographies. |

|

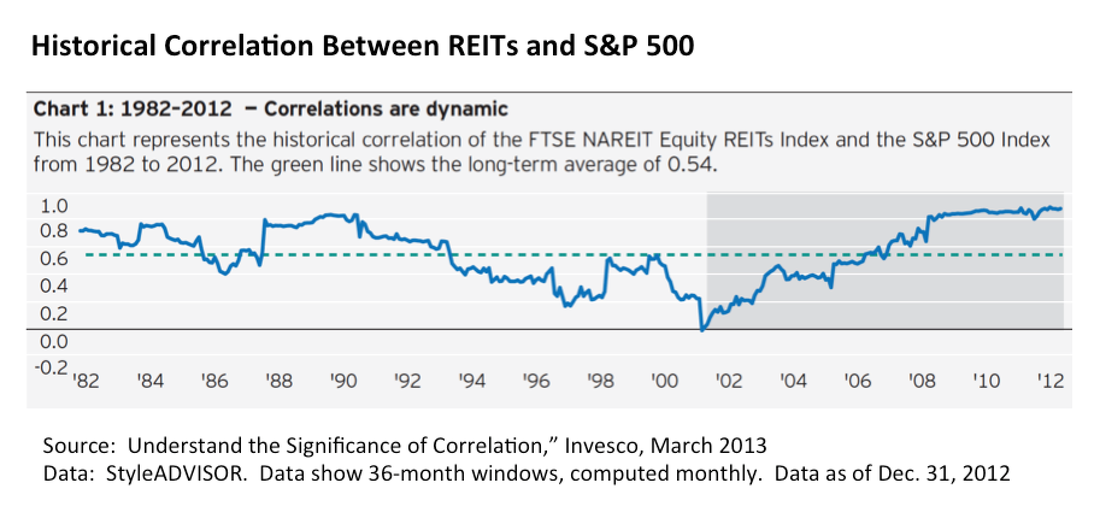

The table below shows that correlations between REITs and the S&P 500 Index are also on the rise. |

|

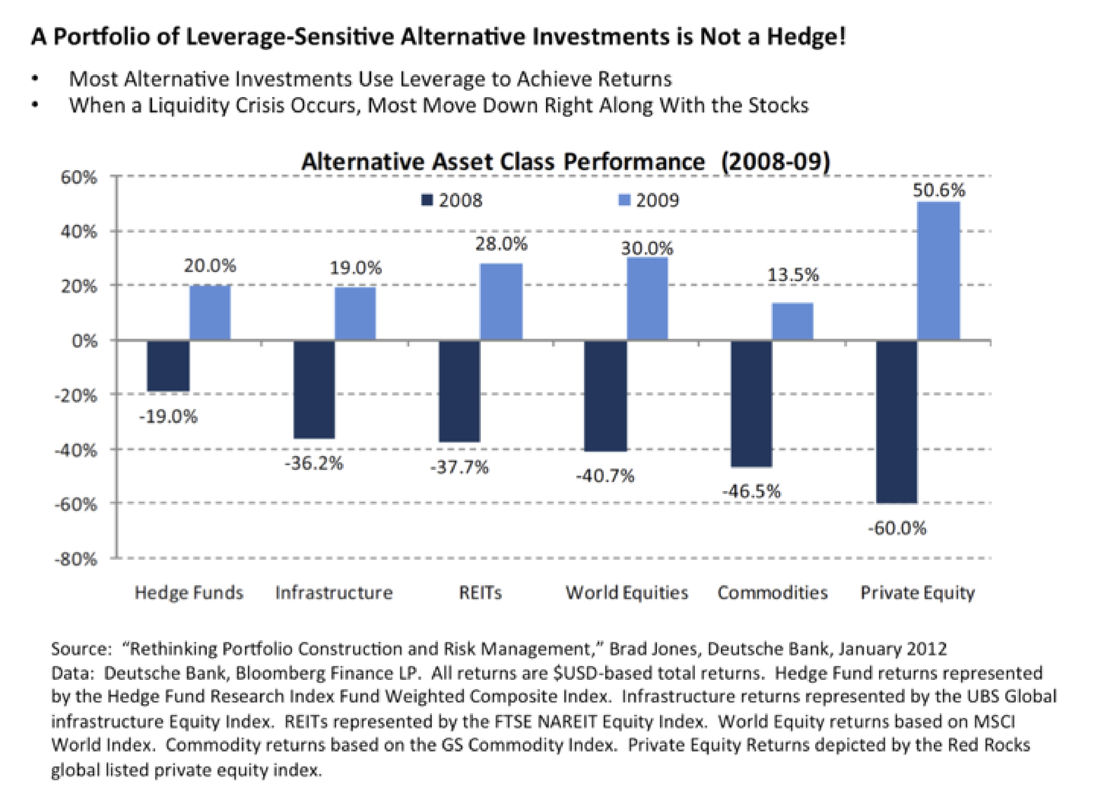

So, the conclusion is that the correlations of foreign currencies, EM stocks, DM stocks, commodities and REITs to the S&P 500 have all increased of the last 20 years. The one asset class not included in the charts above is U.S. Treasury bonds. From our previous section, The Achilles Heel of the 60/40 Portfolio, we showed that bonds and stocks have been non-correlated since around 2000. More recently, however, the stock-bond correlation has risen to its approximate historical average of zero. So after a long period of extreme anti-correlation, even U.S. Treasury bonds are becoming more correlated with stocks. The bottom line in all of this is that with increasing correlations, constructing a diversified portfolio is more difficult than in the past. The recent experience of the 2008 market melt down was that correlations increase in times of crisis. If correlations are already at high levels, how much stability to portfolios will they be able to provide when the next downturn comes? What is needed is something a portfolio can buy that has a low correlation with stocks. Leverage-Sensitive Alternative Investments Are Not a Hedge Against Risk Hedge funds, as the name implies, are designed to hedge the performance of a traditional portfolio by using strategies that are not dependent on the markets. Alternative investments, like private equity pools and managed future funds, are intended to do the same thing. It’s not uncommon for hedge funds and alternative investments to make up 20%-30% of today’s most sophisticated portfolios. Like anything else, the top private equity groups, hedge funds and REITs have provided exceptional returns, but most haven’t. The biggest flaw, however, is that they often don’t reduce portfolio risk during major downturns because the majority use leverage to juice returns! Leverage works fine when the economy and financial market are stable, but when a real crisis occurs, borrowed money exacerbates losses. See the chart below. |

|

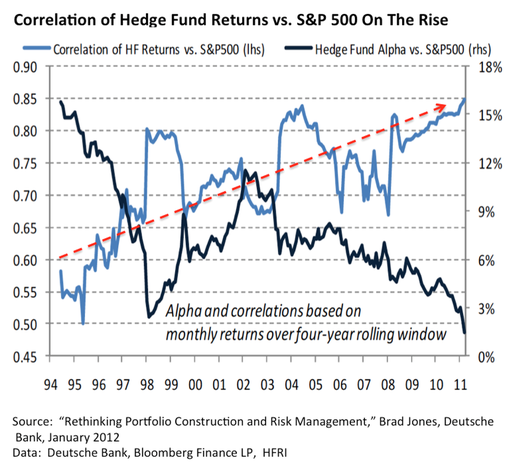

Hedge funds’ returns correlation (blue line, lefthand scale in the chart below) with the S&P 500 has been increasing over last 20 years as well (as its outperformance vs the market has declined). The red line estimates the increasing correlation. |

|

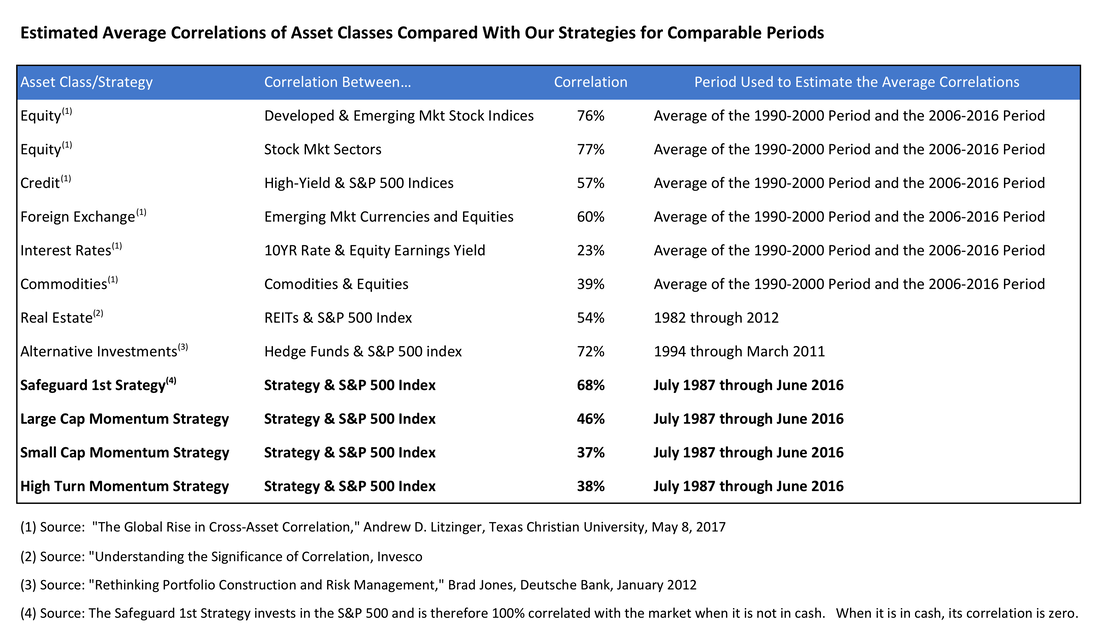

Bringing It All Together The table below compares the correlations of our strategies (in bold) with an estimate of the current correlations of widely-held asset classes in portfolios. Also, compare them to a sample of hedge fund correlations. The time frames differ slightly, but the comparisons are still valid. |

|

Our strategies do not use leverage and have correlations equal to or lower than the alternative investment classes often used in the sophisticated portfolios of sophisticated investors. Key Takeaways The asset classes that are being chosen to construct sophisticated, diversified portfolios for high net-worth and ultra high net-worth investors may not be achieving their risk reduction goals for two reasons:

In our opinion, diversification through alternative strategies rather than different asset classes, should be considered as part of the portfolio construction process of high net-worth and ultra high net-worth investors. |