|

Gradually Shifting Asset Allocations Doesn’t Effectively Reduce Risk

Many asset managers contend that they can reduce risk by gradually changing allocations to different asset classes in the portfolios they manage. For instance, they might aim to increase bond holdings or cash holdings incrementally when markets seem risky. We want the challenge this notion. We don’t believe making small shifts among asset classes is an effective way to reduce risk. Let’s look at three simplified scenarios to illustrate. Assumptions For All Three Scenarios:

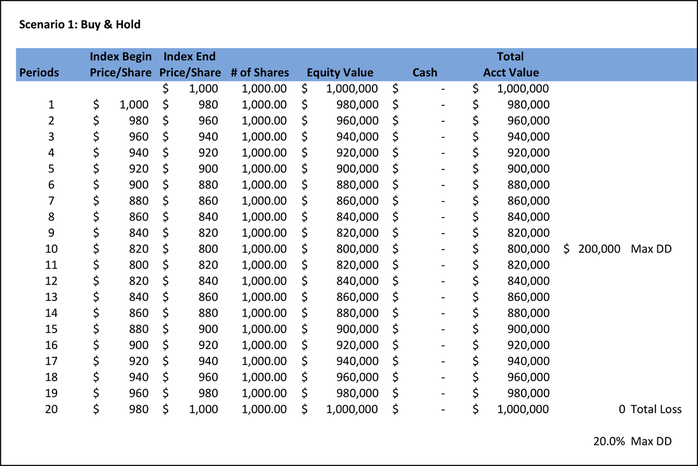

In Scenario 1, we Buy & Hold. The Buy & Hold scenario (Scenario 1) produces a $200,000 maximum drawdown (20%) and no gain or loss. |

|

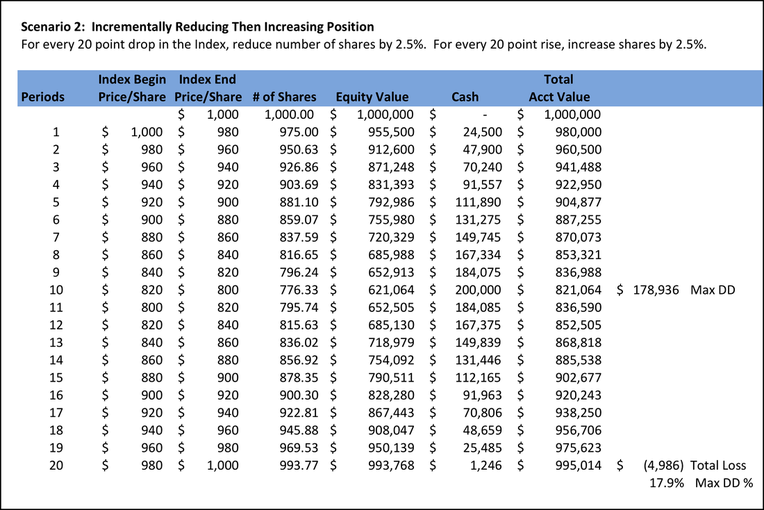

In Scenario 2 below, we have assumed that our portfolio manager sells 2.5% of her shares for each 20 point drop in the index and on the way back up, she increase her shares by 2.5% for each 20 point increase in the index. We further assume that the timing of the portfolio manager is close to perfect: she started selling one period after the top and begins buying one period after the bottom. In the real world, this is unlikely to be case. Gradually shifting positions around may seem like a good idea, but the fact is that it barely reduces risk even when applied in a theoretically perfect way. For all of the selling and buying associated with changing our allocation to reduce risk, we only reduced the maximum drawdown percentage from 20.0 to 17.9 percent, a reduction in drawdown from the Buy & Hold Strategy of only 2.1 percent of the total portfolio value, or $21,000 on a $1 million portfolio. And we suffered a $5,000 loss to achieve this. And this isn't counting any transaction costs. Wouldn’t you just rather buy and hold? |

|

In Scenario 3, our manager sells all her holdings one period after the top. She re-invests all the cash in her account on Period 20, when the index has regained its previous high. The results are a maximum drawdown of $20,000 or 2 percent and a $20,000 loss. Summary

Two points can be made here.

Our example used only one security to keep it simple, but the same result applies to portfolios with many different asset buckets. Small changes in allocations provide limited reductions in portfolio risk. |

|

Key Takeaways The gradual, incremental shifting of allocation among portfolio asset classes is not an effective way to reduce risk. In our view, wealth managers and portfolio managers promote this idea to provide an excuse for charging active management fees for what is essentially passive investing. Our risk management system decisively goes to a 100% cash position when risk is high: our objective is not to lose money. |

|

More Information on This Topic For those who are technical and/or investment professionals, Vanguard produced a white paper that quantifies the comparative risks and rewards of different rebalancing strategies for a 60% equity / 40% bond portfolio. The study covers the period 1929 through 2009. The analysis demonstrates that the frequency of rebalancing to maintain the target portfolio allocations at 60/40 makes little difference in terms of risk or reward. (And taxes and transaction costs were not included in the analysis!). In fact, not rebalancing at all over the 80 year period...

|