|

Drawdown, Maximum Drawdown %, Maximum Drawdown Duration, Net Profit As a % of Max Drawdown

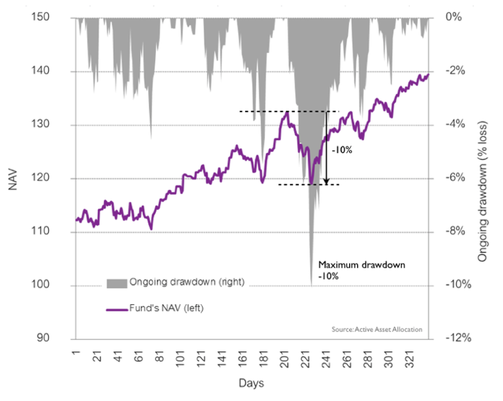

Drawdown is the simplest, most intuitive measure of risk. To calculate drawdown, start with the current price, and then find the highest previous high (high-water mark). Subtract the highest previous high from the current price and divide by the highest previous high. (It is much easier to just look at the chart below!) Maximum Drawdown is the biggest drop in dollars from the previous high for the period in question. Maximum Drawdown % is the Maximum Drawdown in dollars divided by the account’s previous all-time high value in dollars. The chart below illustrates the concept of drawdowns. The grey is the running percentage decline from the previous all time high (the drawdown %). The purple line is the price of the asset and the maximum drawdown % for the period 1 to 321 days is -10%. |

|

For most investors, Maximum Drawdown % may the best measure of risk for two reasons: 1) Large drawdowns are the principle drivers of panic selling at the worst possible time, causing investor to lock in unrecoverable losses, and 2) Drawdowns can last many years in extended bear markets and if the investor needs to raise cash for an emergency or retirement, an investor may be forced to take major losses. The longest drawdown for the period under consideration is called the Maximum Drawdown Duration and is usually measured in weeks. It is defined as the time from the previous all-time high to the time when that all-time high is surpassed (peak to new peak).

Net Profit As A % Of Maximum Drawdown is the net profit gained by a strategy or investment over a given period divided by the maximum drawdown incurred during that time period. |