|

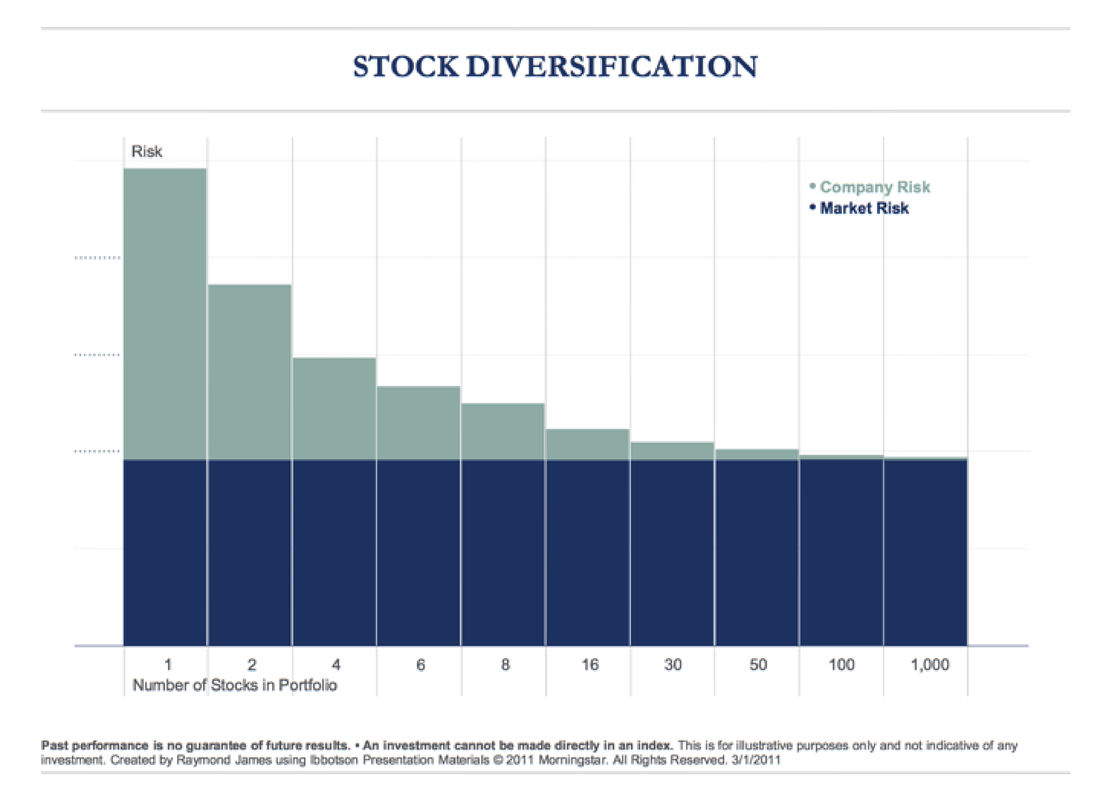

Diversifying Company Risk

How many stocks should a strategy hold to diversify individual company risk? With regard to reducing non-systemic risk (risk due to an individual stock tanking), most of benefits are achieved when around 15 positions are held, which is why our strategies hold at least 15 positions at a time. |